The October 2024 Monthly Economic Report (MER) offers a detailed and nuanced portrait of New Eden’s financial health, revealing trends that could have profound implications for corporations, alliances, and individual capsuleers alike. As we delve into the data, it becomes clear that understanding these economic currents is essential for anyone looking to thrive in this intricate and interconnected world.

A Surge in Mineral Prices: The Double-Edged Sword of Scarcity and Demand

The Mineral Price Index has reached a historic high of 287, a figure that underscores significant shifts in the availability and demand for raw materials across New Eden. This escalation in mineral prices is not merely a statistical anomaly but a reflection of deeper systemic changes affecting both the supply and demand sides of the market.

On the supply front, several factors have contributed to the scarcity of minerals. Ongoing conflicts in key resource-rich regions have disrupted traditional mining operations. Null-Sec territories, often controlled by powerful alliances, have become battlegrounds where mining fleets must contend with not only the dangers of space but also the ever-present threat of enemy action. Pirate activities have surged, and territorial disputes have made certain asteroid belts inaccessible or too risky to exploit effectively.

Demand, however, shows no signs of abating. The continuous need for ships, modules, and infrastructure projects remains strong as corporations expand, alliances fortify their holdings, and pilots seek the latest technology to gain an edge over competitors. The war economy, fueled by both actual and anticipated conflicts, drives this demand further. Industrialists find themselves in a challenging position, facing higher input costs due to expensive minerals while trying to meet the relentless demand for their products.

For miners, this scenario presents both opportunities and challenges. While higher mineral prices can lead to increased profits, the risks associated with extraction have also escalated. The cost of securing mining operations, whether through hiring protection or investing in more robust defensive measures, can offset the gains from selling at higher prices. Additionally, the inefficiencies and resource wastage highlighted in the MER suggest that not all mining operations are capitalizing on the potential benefits of the current market.

Declining Ship Index: A Reflection of Shifting Strategies and Market Dynamics

Parallel to the surge in mineral prices is a notable decline in the Ship Index, which has decreased by approximately 4.5% over the past twelve months. This downward trend in ship values may seem counterintuitive at first glance, especially given the increased costs of raw materials. However, a closer examination reveals underlying factors that contribute to this phenomenon.

One significant aspect is the cautious behavior adopted by many capsuleers in response to the volatile economic climate. The high costs associated with ship production have made pilots more reluctant to invest in new vessels unless absolutely necessary. Instead, there is a tendency to maintain and repair existing ships, extending their operational life to avoid the expenses of replacement.

Moreover, the geopolitical landscape of New Eden has influenced these market dynamics. With fewer large-scale conflicts and massive fleet engagements, the rate at which ships are destroyed has diminished. This reduction in ship losses means that the demand for replacements has decreased accordingly. Alliances and corporations may be focusing on consolidation and defensive strategies rather than aggressive expansion, which traditionally drives higher ship consumption.

The decline in the Ship Index also has implications for manufacturers and traders. An oversupply of ships in the market, combined with reduced demand, can lead to decreased profitability for producers. They must navigate the delicate balance between adjusting production levels to avoid surplus and being prepared for potential spikes in demand should conflicts reignite.

The ISK velocity, a measure of how quickly the in-game currency circulates within the economy, has dipped to around 0.34. This slowdown suggests that players are holding onto their ISK rather than engaging in transactions, a behavior that often stems from economic uncertainty or anticipation of future market developments.

Several factors contribute to this cautious approach. The volatility in mineral and ship prices may lead players to adopt a wait-and-see attitude, delaying significant purchases or investments until the market stabilizes. Furthermore, the potential for inflation—where the value of ISK diminishes due to an increased money supply without a corresponding rise in goods and services—can incentivize players to conserve their resources.

This reduction in economic activity poses challenges for the overall health of New Eden’s economy. A lower ISK velocity can lead to decreased liquidity in the markets, making it harder for players to buy and sell goods efficiently. It can also hinder economic growth, as businesses may struggle to find buyers for their products or to secure the capital needed for expansion.

Addressing this issue may require interventions at both the player and developer levels. Players can contribute by engaging more actively in the economy, seeking out opportunities for trade, investment, and collaboration. Developers might consider introducing incentives to stimulate economic activity, such as events that encourage spending or adjustments to game mechanics that reduce transactional friction.

Null-Sec regions continue to be the powerhouse of New Eden’s resource extraction, contributing significantly to asteroid and moon mining outputs. These areas, often controlled by well-organized alliances, have the potential to capitalize on the high mineral prices and meet the demands of the broader economy. However, the MER highlights a concerning issue: substantial inefficiencies and waste in mining operations.

Resource wastage occurs when mining activities do not extract the maximum possible yield from asteroids or when materials are lost due to ineffective processing and handling. Factors contributing to this inefficiency may include outdated equipment, insufficient training for mining crews, lack of proper fleet coordination, or even complacency resulting from dominant market positions.

The implications of these inefficiencies are far-reaching. For the alliances and corporations operating in Null-Sec, resource wastage translates directly into lost profits and diminished competitive advantage. In an environment where every unit of mineral counts, especially given the current market conditions, optimizing mining operations is not merely beneficial but essential.

Addressing these challenges involves a multifaceted approach. Investment in advanced mining technologies can enhance extraction efficiency and reduce waste. Training programs for personnel can improve operational effectiveness, ensuring that fleets work cohesively and make the best use of available resources. Additionally, implementing stringent oversight and quality control measures can help identify and rectify inefficiencies promptly.

By focusing on these areas, Null-Sec entities can strengthen their economic positions, contribute more effectively to the supply chain, and potentially alleviate some of the pressures caused by mineral scarcity.

The Forge region, anchored by the bustling trade hub of Jita, remains the epicenter of New Eden’s commercial activity. The MER reaffirms its position, showing the highest levels of exports, imports, and overall trade volume. This centralization offers both advantages and challenges for the economy and its participants.

On the positive side, The Forge provides unparalleled market liquidity, with a vast array of goods available and a steady flow of transactions. Players can reliably buy and sell items, find competitive prices, and access a wide range of commodities. For traders and industrialists, operating in such a vibrant market can lead to significant opportunities for profit.

However, this centralization also poses systemic risks. The reliance on a single region for the bulk of trade activity makes the economy vulnerable to disruptions. Events such as market manipulation by powerful entities, infrastructure attacks, or policy changes can have outsized impacts on the entire economic landscape. Moreover, smaller markets in other regions may struggle to develop, leading to economic imbalances across New Eden.

Diversification of trade hubs could mitigate some of these risks. Encouraging the growth of alternative markets in regions like Amarr, Dodixie, or emerging areas such as Pochven can distribute economic activity more evenly. This approach not only reduces the vulnerability associated with centralization but also fosters regional development and provides players with more varied opportunities.

Players can contribute to this diversification by choosing to engage in trade outside of The Forge, supporting local markets, and exploring niche opportunities that may be less competitive but equally rewarding.

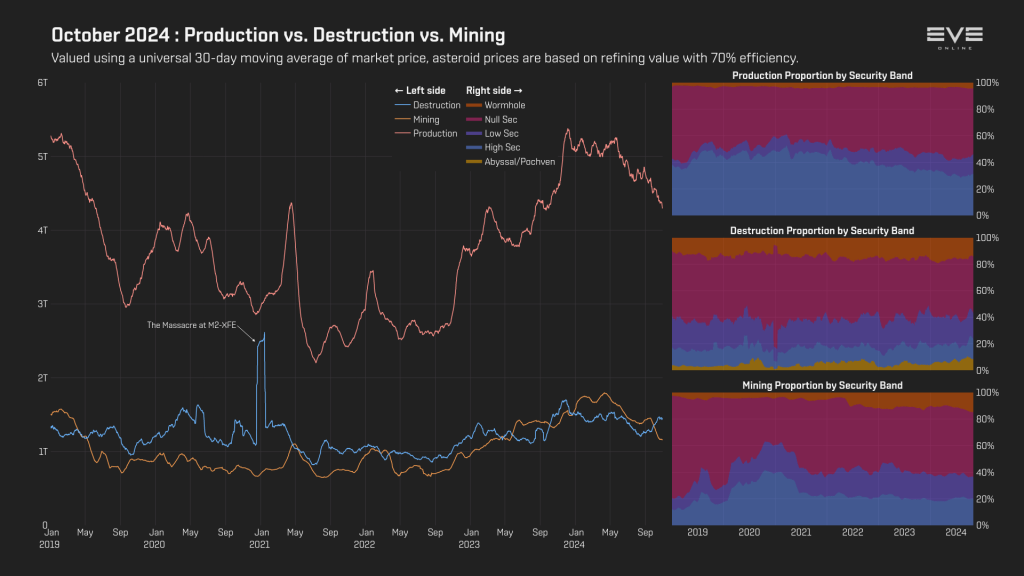

Destruction is an inherent part of EVE Online’s ecosystem, and the MER’s report of over 500,000 ship kills in October alone underscores the scale of conflict within New Eden. This constant cycle of destruction and renewal is a driving force for economic activity, influencing supply chains, market demand, and player behavior.

When ships and equipment are destroyed, they need to be replaced, generating demand for manufacturing and resource extraction. This demand stimulates various sectors of the economy, from miners and industrialists to traders and haulers. The production of replacement ships and modules injects vitality into the markets and provides opportunities for profit and growth.

Major alliances and corporations play pivotal roles in this dynamic. Their strategic decisions, whether to engage in large-scale warfare or focus on defensive posturing, have significant implications for the economy. A period of intense conflict can lead to spikes in demand for military hardware, while prolonged peace may result in decreased economic activity in related sectors.

Understanding the patterns and drivers of conflict can help players anticipate market trends and adjust their strategies accordingly. For industrialists and traders, aligning production and inventory with potential surges in demand can enhance profitability. Combat-focused players may find opportunities in mercenary work, security services, or by participating in factional warfare that can shape the economic landscape.

Maintaining a healthy balance between ISK entering and leaving the economy is crucial for stability and long-term sustainability. The MER highlights shifts in this balance, notably the increased prominence of broker fees as an ISK sink following changes in game mechanics.

Broker fees, which are incurred during market transactions, have become a significant factor affecting traders’ profitability. Higher fees reduce net gains from sales, potentially discouraging high-volume trading or prompting players to seek alternative methods of transaction, such as direct trades or contracts.

On the faucet side, activities like NPC bounties and mission rewards continue to introduce ISK into the economy. These sources provide steady income for players engaged in PvE content, contributing to the overall money supply.

The balance between these sinks and faucets influences inflationary pressures and the value of ISK. If faucets significantly outpace sinks, the increased money supply can lead to inflation, reducing purchasing power. Conversely, if sinks are too aggressive, they can drain liquidity from the economy, hindering economic activity.

Players can navigate these dynamics by optimizing their trading strategies to account for higher transaction costs, diversifying income sources, and staying informed about potential changes in game mechanics that affect the ISK flow.

While established regions continue to dominate economic activity, the MER suggests that emerging areas like Pochven offer new opportunities for players willing to explore uncharted territories. Pochven, with its unique environmental conditions and resources, presents a distinct set of challenges and rewards.

The region’s isolation and the presence of hostile entities create barriers to entry, but also lead to less competition in certain markets. Rare materials and exclusive loot available in Pochven can command high prices in broader markets, offering substantial profits for those capable of securing and transporting them.

Engaging with these frontier regions requires careful planning and risk assessment. Players must equip themselves appropriately, develop strategies to mitigate threats, and establish reliable logistics for moving goods in and out of these areas.

By venturing into these less-exploited regions, players can diversify their activities, contribute to the economic development of new markets, and potentially gain competitive advantages over those who remain in more conventional spaces.

The combination of a growing ISK supply and reduced economic activity raises concerns about inflation within New Eden. Inflation can erode the value of ISK, increase the cost of goods and services, and create uncertainty that further dampens economic engagement.

Addressing these pressures may require coordinated efforts from both the player community and the game’s developers. Potential strategies include:

For players, staying informed about these developments is crucial. Adapting strategies to account for changing economic conditions, seeking out education on market dynamics, and participating in community discussions can enhance one’s ability to navigate the complexities of New Eden’s economy.

The October 2024 Monthly Economic Report offers a comprehensive view of New Eden’s financial landscape, revealing a complex interplay of factors that influence the experiences of every capsuleer. From record-high mineral prices and a declining ship market to the nuances of ISK flow and the potential of emerging regions, the data underscores the importance of economic literacy in the pursuit of success within EVE Online.

For corporations and alliances, strategic planning that considers these economic indicators can enhance competitiveness and resilience. Individual players, whether they are miners, industrialists, traders, or combat pilots, can benefit from understanding how these trends impact their activities and opportunities.

In a universe as dynamic and interconnected as New Eden, the economy is both a mirror and a driver of player actions and ambitions. Navigating its complexities requires not only skill and adaptability but also a willingness to engage with the broader forces at play.

As we move forward, the challenges presented by the current economic climate also offer avenues for innovation and growth. By embracing the intricacies of the market, collaborating with others, and remaining vigilant to changes, players can not only weather the uncertainties ahead but also shape the future of New Eden’s economy.

In the realm of internet spaceships, serious business is indeed conducted with every transaction and every decision. Understanding and participating in the economic tapestry of EVE Online enriches the gameplay experience and opens doors to new possibilities.

Philosopher. Warrior. Haiku Poet.

Somewhere beyond the shattered wormholes of Anoikis, riverini drifts—a ghost in the vast, cold expanse of null-sec. Bound neither by time nor by space, he waits for the call to chaos.

Until then, his words are the weapon.